Search

Content type: Advocacy

Privacy International welcomes this opportunity to submit comments to the FATF consultation. The draft recommendation is an improvement on existing guidance that we have reviewed.

We also welcome the calls of the FATF for accommodations that will relieve burdens upon individuals who are being excluded from the financial sector, as a result of the FATF’s prior recommendations.

PI believes that identity systems must empower people. The initial question surrounding the development of any…

Content type: Examples

The State is not always the only actor involved in the surveillance of benefits claimants. Often those practices are encouraged, facilitated or conducted by private companies. South Africa for instance mandated MasterCard to help distribute benefits through biometric debit cards.

https://www.finextra.com/newsarticle/23941/south-africa-enlists-mastercard-to-distribute-welfare-through-biometric-debit-cards

Publication: FinExtra

Content type: Examples

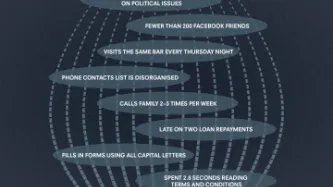

Because banks often decline to give loans to those whose "thin" credit histories make it hard to assess the associated risk, in 2015 some financial technology startups began looking at the possibility of instead performing such assessments by using metadata collected by mobile phones or logged from internet activity. The algorithm under development by Brown University economist Daniel Björkegren for the credit-scoring company Enterpreneurial Finance Lab was built by examining the phone records…

Content type: News & Analysis

Privacy International is celebrating Data Privacy Week, where we’ll be talking about privacy and issues related to control, data protection, surveillance and identity. Join the conversation on Twitter using #dataprivacyweek.

If you were looking for a loan, what kind of information would you be happy with the lender using to make the decision? You might expect data about your earnings, or whether you’ve repaid a loan before. But, in the changing financial sector, we are seeing more and more…