Search

Content type: Examples

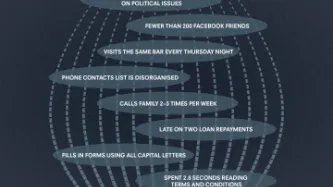

In October 2018, the Singapore-based startup LenddoEFL was one of a group of microfinance startups aimed at the developing world that used non-traditional types of data such as behavioural traits and smartphone habits for credit scoring. Lenddo's algorithm uses numerous data points, including the number of words a person uses in email subject lines, the percentage of photos in a smartphone's library that were taken with a front-facing camera, and whether they regularly use financial apps on…

Content type: News & Analysis

Privacy International is celebrating Data Privacy Week, where we’ll be talking about privacy and issues related to control, data protection, surveillance and identity. Join the conversation on Twitter using #dataprivacyweek.

If you were looking for a loan, what kind of information would you be happy with the lender using to make the decision? You might expect data about your earnings, or whether you’ve repaid a loan before. But, in the changing financial sector, we are seeing more and more…