Search

Content type: Advocacy

Privacy International welcomes this opportunity to submit comments to the FATF consultation. The draft recommendation is an improvement on existing guidance that we have reviewed.

We also welcome the calls of the FATF for accommodations that will relieve burdens upon individuals who are being excluded from the financial sector, as a result of the FATF’s prior recommendations.

PI believes that identity systems must empower people. The initial question surrounding the development of any…

Content type: Long Read

[Photo credit: Images Money]

The global counter-terrorism agenda is driven by a group of powerful governments and industry with a vested political and economic interest in pushing for security solutions that increasingly rely on surveillance technologies at the expenses of human rights.

To facilitate the adoption of these measures, a plethora of bodies, groups and networks of governments and other interested private stakeholders develop norms, standards and ‘good practices’ which often end up…

Content type: Examples

In October 2018, the Singapore-based startup LenddoEFL was one of a group of microfinance startups aimed at the developing world that used non-traditional types of data such as behavioural traits and smartphone habits for credit scoring. Lenddo's algorithm uses numerous data points, including the number of words a person uses in email subject lines, the percentage of photos in a smartphone's library that were taken with a front-facing camera, and whether they regularly use financial apps on…

Content type: Examples

After an 18-month investigation involving interviews with 160 life insurance companies, in January 2019 New York Financial Services, the state's top financial regulator, announced it would allow life insurers to use data from social media and other non-traditional sources to set premium rates for its customers. Insurers will be required to demonstrate that their use of the information doesn't unfairly discriminate against specific customers. New York is the first state to issue specific…

Content type: Long Read

By Valentina Pavel, PI Mozilla-Ford Fellow, 2018-2019

Our digital environment is changing, fast. Nobody knows exactly what it’ll look like in five to ten years’ time, but we know that how we produce and share our data will change where we end up. We have to decide how to protect, enhance, and preserve our rights in a world where technology is everywhere and data is generated by every action. Key battles will be fought over who can access our data and how they may use it. It’s time to take…

Content type: Examples

The State is not always the only actor involved in the surveillance of benefits claimants. Often those practices are encouraged, facilitated or conducted by private companies. South Africa for instance mandated MasterCard to help distribute benefits through biometric debit cards.

https://www.finextra.com/newsarticle/23941/south-africa-enlists-mastercard-to-distribute-welfare-through-biometric-debit-cards

Publication: FinExtra

Content type: Examples

Because banks often decline to give loans to those whose "thin" credit histories make it hard to assess the associated risk, in 2015 some financial technology startups began looking at the possibility of instead performing such assessments by using metadata collected by mobile phones or logged from internet activity. The algorithm under development by Brown University economist Daniel Björkegren for the credit-scoring company Enterpreneurial Finance Lab was built by examining the phone records…

Content type: News & Analysis

Privacy International is celebrating Data Privacy Week, where we’ll be talking about privacy and issues related to control, data protection, surveillance and identity. Join the conversation on Twitter using #dataprivacyweek.

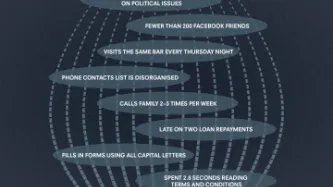

If you were looking for a loan, what kind of information would you be happy with the lender using to make the decision? You might expect data about your earnings, or whether you’ve repaid a loan before. But, in the changing financial sector, we are seeing more and more…

Content type: Examples

In 2015, the Swedish startup hub Epicenter began offering employees microchip implants that unlock doors, operate printers, and pay for food and drink. By 2017, about 150 of the 2,000 workers employed by the hub's more than 100 companies had accepted the implants. Epicenter is just one of a number of companies experimenting with this technology, which relies on Near Field Communication (NFC). The chips are biologically safe, but pose security and privacy issues by making it possible to track…